Married couples burdened by high-interest credit card debt can find relief through Joint Debt Consolidation Loans. These loans simplify payments, reduce interest costs, and provide financial clarity. Key steps include assessing financial situations, improving credit profiles, and creating a structured repayment plan. By selecting the right lender, comparing rates, and securing pre-approval, couples can effectively consolidate debt, regain control of their finances, and establish long-term financial stability.

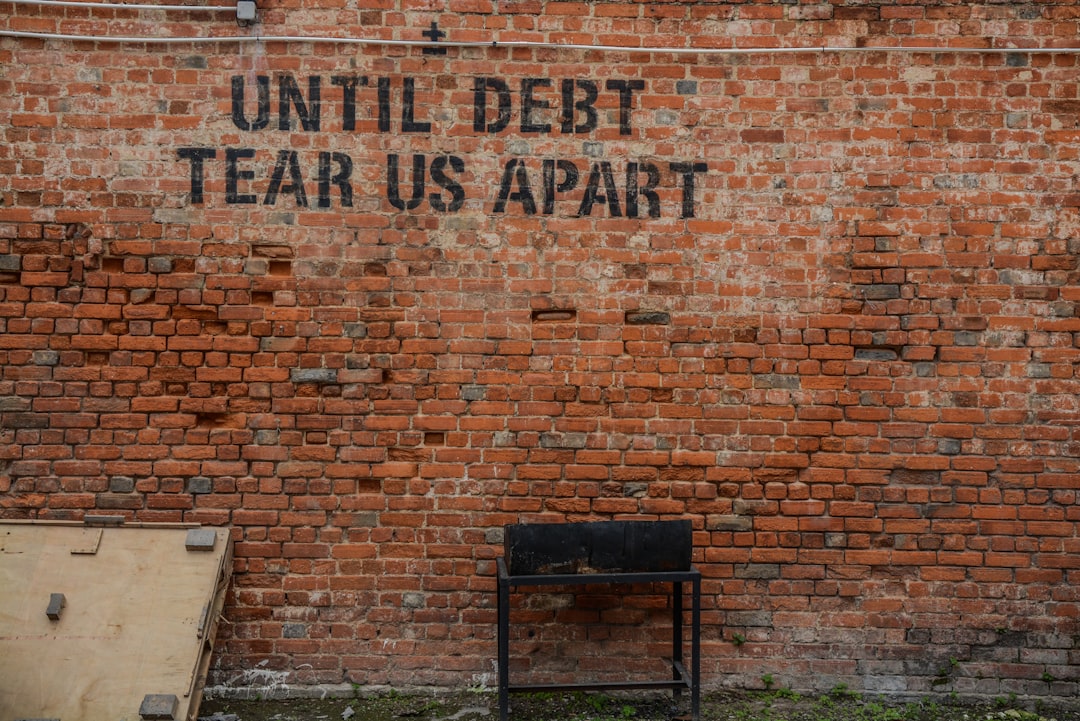

Married couples facing mounting credit card debt have an effective solution: joint debt consolidation loans. This strategy allows them to combine multiple high-interest debts into a single, more manageable loan with a lower interest rate. By consolidating credit card debt, couples can simplify repayment, reduce financial stress, and free up disposable income for shared goals. This article explores the benefits, eligibility criteria, lender selection, application process, and long-term management strategies for these loans.

- Understanding Joint Debt Consolidation Loans

- Benefits of Consolidating Credit Card Debt for Married Couples

- Eligibility Criteria for Debt Consolidation Loans

- How to Choose the Right Lender for Your Needs

- Steps Involved in Securing a Joint Debt Consolidation Loan

- Managing Repayments and Avoiding Future Debt Accumulations

Understanding Joint Debt Consolidation Loans

In the journey towards financial stability, married couples facing a sea of debt can find hope in Joint Debt Consolidation Loans. These loans are designed to simplify the process of consolidating various forms of debt, including credit card debt, into a single payment. By pooling their resources and applying for this loan together, both partners share the responsibility and burden equally, making it easier to manage and ultimately pay off their debts faster.

This approach offers several advantages. Firstly, it allows couples to negotiate better interest rates as they present a unified front with a higher combined creditworthiness. Secondly, consolidating debt into one payment stream can simplify budgeting by replacing multiple bills with just one monthly obligation, reducing the risk of missing payments due to overlapping due dates. This strategic move paves the way for couples to regain control over their finances and set them on a path towards financial freedom.

Benefits of Consolidating Credit Card Debt for Married Couples

For married couples facing a mountain of credit card debt, consolidating can offer a much-needed breath of fresh air. By combining multiple high-interest credit card balances into one low-interest loan, couples can simplify their finances and save significant money in interest payments over time. This strategic move allows for easier budgeting and the potential to pay off their debts faster.

Consolidating debt provides clarity and control by consolidating all outstanding balances onto a single payment schedule. This reduces the mental burden of keeping track of multiple due dates, enabling couples to focus on building a more secure financial future. Moreover, with lower monthly payments, there’s room in the budget for other important expenses or even unexpected costs without adding to existing debt.

Eligibility Criteria for Debt Consolidation Loans

Married couples facing mounting credit card debt have an option that can simplify their financial situation: joint debt consolidation loans. These loans are designed to help individuals with a single stable income consolidate multiple high-interest credit cards into one manageable payment, offering significant relief and long-term savings.

Eligibility for these loans often includes a few key factors. Lenders typically require at least one borrower to have a strong credit history, demonstrating responsible financial management. A steady and substantial income is another critical requirement, ensuring the couple can comfortably afford the loan repayments. Additionally, lenders may assess the overall debt-to-income ratio, ensuring the new consolidated loan fits within a sustainable budget.

How to Choose the Right Lender for Your Needs

When considering a joint debt consolidation loan with limited income, choosing the right lender is paramount. Start by comparing interest rates and loan terms offered by various financial institutions. Look for lenders specializing in debt consolidation loans for low-income couples to ensure they understand your unique situation. Online reviews can be invaluable; check out what others say about the lender’s customer service and transparency.

Additionally, pay attention to any hidden fees or charges associated with the loan. Some lenders may have stringent requirements, so ensure you meet their criteria before applying. Consider reaching out to multiple lenders for pre-approval to understand your options better and secure the best terms for consolidating your credit card debt effectively.

Steps Involved in Securing a Joint Debt Consolidation Loan

Securing a joint debt consolidation loan for married couples with one primary income involves several key steps. Firstly, both partners should assess their current financial situation and understand the extent of their combined debt. This includes reviewing all outstanding credit card balances, loans, and any other financial obligations. Once a comprehensive overview is established, they can begin exploring consolidation options tailored to their specific circumstances.

Next, it’s crucial to enhance their creditworthiness as a couple. Lenders will consider both partners’ credit scores when evaluating the loan request. Improving individual credit profiles through responsible spending habits, timely bill payments, and managing existing debt responsibly can significantly increase the chances of securing favorable loan terms. Additionally, joint accounts with a history of positive payment behavior can positively impact their collective creditworthiness.

Managing Repayments and Avoiding Future Debt Accumulations

Managing repayments is a crucial aspect of joint debt consolidation, especially for couples relying on a single income. By combining multiple debts into one loan with a lower interest rate, couples can simplify their financial obligations and make consistent, manageable payments. A well-structured repayment plan allows them to allocate a fixed amount from their budget each month, ensuring they stay on track without overextending themselves. This disciplined approach not only helps in repaying the consolidated debt but also encourages responsible spending habits.

To avoid future debt accumulations, married couples should focus on building a solid financial foundation. This includes creating a detailed budget that accounts for essential expenses, savings goals, and debt repayment. By consistently adhering to this budget, they can prevent unnecessary borrowing and maintain control over their finances. Additionally, educating themselves about personal finance and debt management will empower them to make informed decisions, ensuring they stay debt-free and secure their financial future together.

Married couples facing mounting credit card debt can find relief through joint debt consolidation loans. By understanding the benefits, eligibility criteria, and steps involved, they can make an informed decision to consolidate their debts effectively. Choosing the right lender and managing repayments responsibly are key to avoiding future accumulations and achieving financial stability. Remember that consolidating credit card debt is a strategic move towards a greener financial future.