Debt consolidation for homebuyers allows them to merge high-interest credit card debts into a single, lower-interest loan, simplifying budgeting and saving on interest expenses. It clears the path to homeownership by freeing up income for a down payment and improving creditworthiness for better mortgage deals. Understanding fixed-rate and adjustable-rate mortgages strategically aids in consolidating debt and achieving homeownership. Eligibility is determined by factors like credit score, income, existing debt, and employment history. Applying involves assessing financial situations, researching lenders, preparing documents, and submitting an accurate application. Consolidating credit card debt through refinancing or switching to low-interest cards saves money and reduces costs, as demonstrated by real-life success stories.

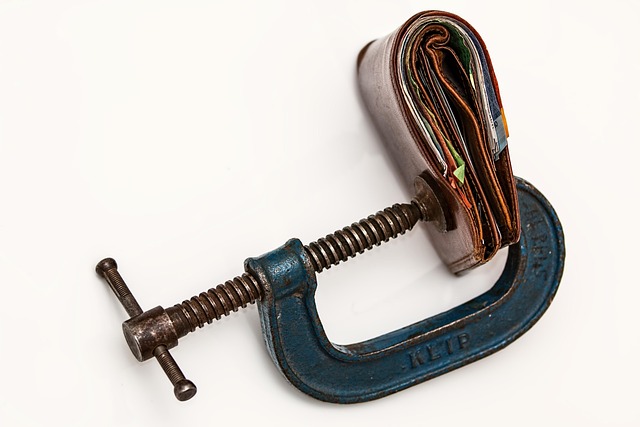

“Thinking of buying your dream home but burdened by credit card debt? Explore powerful debt consolidation mortgage options that can make homeownership a reality. This guide uncovers the intricacies of consolidating credit card debt through mortgages, offering a clear roadmap for homebuyers.

From understanding the benefits to navigating application processes, you’ll discover how this strategy streamlines financial goals. Learn about various mortgage types, qualifying criteria, and cost-saving strategies. Real-life success stories inspire, showcasing how debt consolidation paves the way to secure your future home.”

- Understanding Debt Consolidation and Its Benefits for Homebuyers

- Types of Mortgages for Debt Consolidation: A Comprehensive Overview

- Qualifing for a Debt Consolidation Mortgage: What Lenders Look For

- The Process of Applying for a Debt Consolidation Loan for a New Home Purchase

- Strategies to Maximize Savings and Reduce Costs During Consolidation

- Real-World Success Stories: How Debt Consolidation Facilitated Homeownership

Understanding Debt Consolidation and Its Benefits for Homebuyers

Debt consolidation is a strategic financial move that can significantly benefit homebuyers. By consolidating credit card debt, individuals can streamline multiple high-interest payments into a single, more manageable loan with a lower interest rate. This not only simplifies budgeting and repayment but also saves money in the long run by reducing overall interest expenses.

For prospective homeowners, this approach offers a clear financial path to achieve their dream of buying a new home. It allows them to allocate a larger portion of their income towards a down payment, improving their chances of securing a favorable mortgage deal. Additionally, debt consolidation can enhance creditworthiness, making it easier to qualify for a mortgage and potentially leading to better loan terms.

Types of Mortgages for Debt Consolidation: A Comprehensive Overview

When considering debt consolidation for credit card debt before buying a new home, understanding your mortgage options is essential. There are several types of mortgages designed to help individuals manage their debt effectively while pursuing homeownership. Fixed-rate mortgages offer consistent payments over the life of the loan, providing stability and predictability for your budget. This type is ideal for those who plan to stay in their home for an extended period.

Adjustable-rate mortgages (ARMs), on the other hand, feature interest rates that fluctuate based on market conditions. Initial rates are typically lower than fixed rates, making ARMs appealing for those expecting to refinance or pay off the loan before rate adjustments. However, it’s crucial to be mindful of potential increases in monthly payments over time. Exploring these mortgage options allows borrowers to strategically consolidate credit card debt, improve their financial standing, and take a step closer to achieving their dream of owning a new home.

Qualifing for a Debt Consolidation Mortgage: What Lenders Look For

When considering a debt consolidation mortgage to buy a new home, understanding your eligibility is key. Lenders assess several factors to determine if you qualify for this financial option. One primary concern is your credit score; a higher score indicates better creditworthiness and can make you a more attractive borrower. Lenders will also review your income-to-debt ratio, ensuring that your monthly earnings cover your existing debts and any new mortgage payments comfortably.

In addition to these basics, lenders evaluate the type and amount of debt you carry, especially high-interest credit card debt. Consolidation mortgages are often appealing for those seeking to reduce their monthly payments and interest rates. Lenders will consider your ability to consistently make repayments over the loan term, looking at employment history and stability as well. A solid down payment can also enhance your application’s success, demonstrating your financial commitment to the purchase.

The Process of Applying for a Debt Consolidation Loan for a New Home Purchase

Applying for a debt consolidation loan to purchase a new home involves several key steps. Firstly, assess your financial situation and determine your eligible credit card debt to be consolidated. This helps in understanding the scope of your loan requirement accurately. Next, research various lenders offering debt consolidation mortgages, comparing interest rates, terms, and conditions to find the best fit for your needs.

Once you’ve identified suitable lenders, prepare necessary documents such as income statements, employment verification, and details of existing debt. Submit these along with your loan application, providing honest and accurate information. Lenders will evaluate your financial health and creditworthiness before making a decision on your debt consolidation mortgage request.

Strategies to Maximize Savings and Reduce Costs During Consolidation

When consolidating credit card debt, there are several strategies to maximize savings and reduce costs. One key approach is to focus on lowering interest rates by negotiating with lenders or exploring options like refinancing or switching to a low-interest credit card. This can significantly cut down on the overall cost of repayment.

Additionally, creating a strict budget and adhering to it during consolidation is crucial. By carefully tracking expenses and allocating funds, individuals can ensure they pay off their debt faster while saving money on interest. Prioritizing high-interest debts first and avoiding new charges can also optimize savings, leading to quicker financial freedom and reduced costs over time.

Real-World Success Stories: How Debt Consolidation Facilitated Homeownership

Many individuals dream of owning their own home, but the path to achieving this goal can often be hindered by overwhelming debt, especially credit card debt. This is where consolidating credit card debt plays a pivotal role in making homeownership a reality. Numerous real-world success stories attest to the transformative power of debt consolidation.

For instance, consider Sarah and her partner who, before they started their home search, were burdened with high-interest credit card balances. Through strategic debt consolidation, they consolidated their debts into a single loan with a lower interest rate, freeing up significant monthly cash flow. This financial reprieve enabled them to comfortably afford a down payment on their first home, turning their dream of owning a space of their own into an exciting reality. Such narratives illustrate how consolidating credit card debt can serve as a gateway to achieving one’s housing aspirations.

Debt consolidation can be a powerful tool for homebuyers looking to secure their financial future. By consolidating credit card debt, individuals can streamline their payments, reduce overall interest expenses, and free up funds for the exciting journey of purchasing a new home. This article has provided an in-depth guide to navigating the process, from understanding the benefits to qualifying for mortgages and maximizing savings. Remember that, with careful planning and the right strategies, debt consolidation can be a game-changer, enabling folks to achieve their dream of homeownership while maintaining financial stability.