Struggling with multiple credit card payments? Consolidate Credit Card Debt offers a strategic solution by merging all balances into one loan with lower interest rates and manageable terms, simplifying monthly payments, freeing up cash flow, and enhancing money management. This powerful tool helps regain control over finances and reduces overall debt costs.

Struggling with multiple credit card payments? Consider personal loan consolidation as a strategic solution. This article explores how combining your credit card debt into one loan can simplify repayment and potentially save you money. We break down the benefits of credit card debt consolidation, from reduced interest rates to improved cash flow management. Learn about the step-by-step process, making it easier than ever to take control of your finances and consolidate your credit card debt effectively.

- Understanding Credit Card Debt Consolidation and Its Benefits

- The Process of Combining Multiple Loans into One for Efficient Repayment

Understanding Credit Card Debt Consolidation and Its Benefits

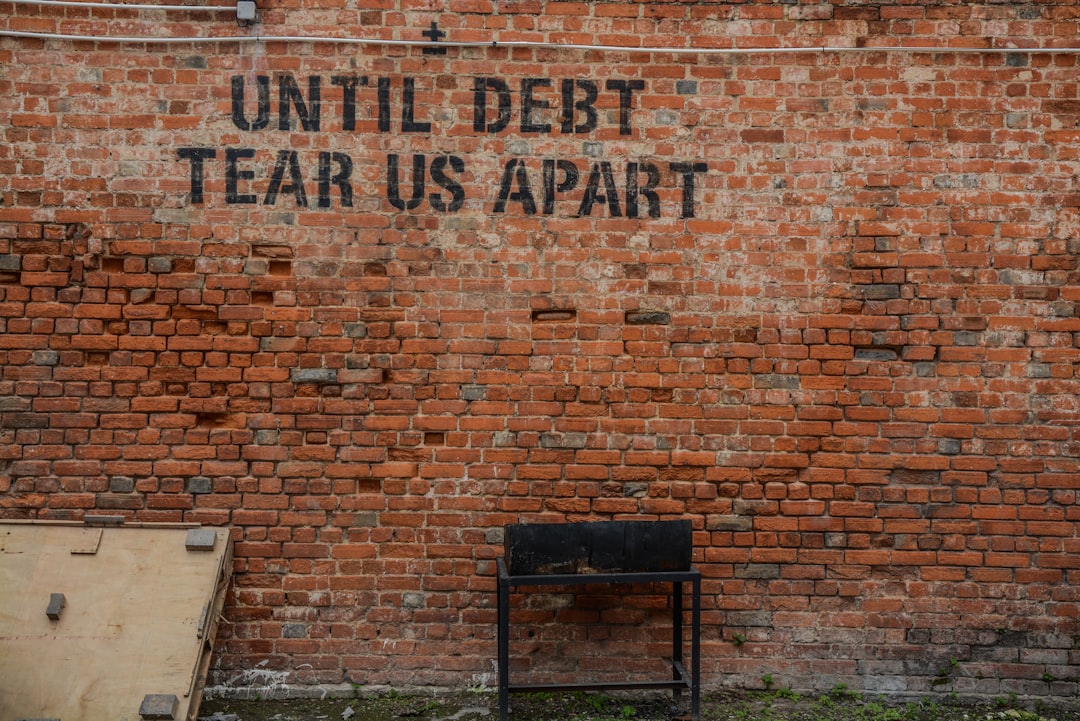

Many individuals face the challenge of managing multiple credit card payments, often leading to a complex and stressful financial situation. This is where consolidate credit card debt comes into play as a strategic solution. By consolidating, you combine all your credit card balances into a single loan with a potentially lower interest rate and more manageable terms.

This process simplifies repayment by reducing the number of payments you need to make each month, making it easier to stay on top of your finances. Moreover, consolidating debt can free up extra cash flow, allowing you to budget better or even save for other financial goals. It’s a powerful tool to regain control and gain clarity in managing your money effectively.

The Process of Combining Multiple Loans into One for Efficient Repayment

Combining multiple loans into one, often referred to as debt consolidation, is a strategic approach designed to simplify repayment and potentially reduce interest expenses. This process involves taking out a new loan with a lower interest rate that covers all existing debts. The borrower then uses this consolidated loan to pay off their previous debts, effectively merging them into a single, manageable payment.

By consolidating credit card debt, individuals can bid farewell to multiple monthly payments and the administrative hassle they bring. It streamlines repayment, making it easier to keep track of just one loan. Moreover, if the new loan offers a lower interest rate, borrowers can save on the overall cost of their debt, freeing up funds that were previously allocated for multiple payments.

Personal loan consolidation, especially through combining credit card debt with a single loan, offers a strategic approach to financial management. By streamlining multiple payments into one manageable schedule, individuals can simplify their finances, reduce stress, and potentially save money on interest rates. This method allows for better control over debt repayment, making it an effective strategy for those seeking to regain financial stability and avoid the complexities of multiple credit card bills. Consolidate Credit Card Debt today and take a significant step towards a debt-free future.